You might be tempted to help a friend or family member get financing for a car or to pay for college because you can, and it feels great to help someone in need. But before you become a cosigner and agree to pay back another borrower’s debt if they can’t themselves, consider all the risks and rewards.

The rewards of cosigning

When you agree to cosign on a loan or credit card, you’re allowing your good credit score and credit history to improve the borrower’s odds of getting approved for a loan or credit card.

If you cosign for an LGFCU New Auto Loan or LGFCU Visa® Credit Card, the loan or credit card will appear on both of your credit reports. Assuming all payments are made on time, the positive payment history contributes to your credit score as well as theirs.

Finances aside, cosigning for someone close to you may be good for personal relationships. You’ll probably feel good knowing you’ve helped a friend or family member attend school, buy their first home or simply have a reliable car to get to work. Plus, it’s an opportunity to help them learn to manage credit responsibly.

The risks of cosigning

As a cosigner, you’re as legally responsible as the borrower. If the payments are late, this negative mark will appear on your credit report as well as theirs. If they default on the loan, you’re in default. This could hurt your credit score. So, if you want to help, it may be worth having access to the account to ensure payments are made on time.

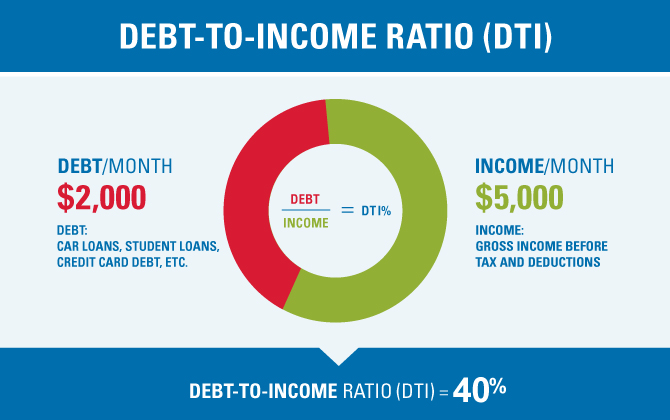

It’s also important to know that cosigning increases your debt-to-income ratio (DTI). This number represents all your monthly debt payments divided by your gross monthly income. For example, if you earn $5,000 a month and have debt payments of $2,000, your DTI is 40%, which is below the recommended 43% ceiling. That’s a good place to be, but it’s close to the recommended max. Review your finances before taking on additional debt. A higher DTI could reduce your chances of getting new credit if you need it or it could lower your credit score.

Lastly, the impact of cosigning could not only affect your personal finances, but non-payment could cause friction between family members or friends. Before agreeing to help, weigh the potential risk to your personal relationship and be sure you’re ready to accept the outcome.

Cosigning is one way to lend a financial lifeline to a friend or family member in need. However, it’s important to know how it could affect your life before you sign.

The advice provided is for informational purposes only. Contact a financial advisor for additional guidance.

APR = Annual Percentage Rate. New Auto Loan is subject to approval. Rates and credit limit are evaluated based on credit history. A new vehicle is defined as current, prior or upcoming model year with 10,000 miles or less. LGFCU will finance 100% of the MSRP, plus an additional 20% to cover purchase-related expenses such as tax, tags and extended warranties. Cash-out is not permitted on purchase transactions and cash-out refinance transactions are limited to a maximum Loan to Value of 100%. Lending is limited to residents in NC, SC, GA, TN and VA. No pre-payment penalties. Vehicles with branded (flooded, salvaged or reconstructed) titles or motorcycles, boats, RVs and commercial vehicles are not acceptable collateral. Product availability and current rates may be changed at any time at the discretion of the Board of Directors. Borrower must maintain collision and comprehensive insurance protection with a maximum deductible of $1,000 for the life of the loan. Must be age 18 or older to qualify for lending services.