Federally insured

LGFCU is federally insured by the National Credit Union Administration (NCUA), a federal agency that administers the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF, like the FDIC's Deposit Insurance Fund, is a federal deposit insurance fund backed by the full faith and credit of the U.S. Government.

There are two ways to tell if we’re federally insured by NCUA. Start by searching the NCUA’s online Credit Union Locator to verify our status. Like all credit unions, we display the official NCUA insurance sign in our advertising, where deposits are normally accepted (e.g., branches, ATMs, etc.), and on our website. There are no charges or fees assessed to you for this coverage.

Our way of protecting you

The NCUA protects members against losses should a federally insured credit union fail. Not one penny of insured savings has ever been lost by a member of a federally insured credit union. No credit union may terminate its federal insurance without first notifying its members.

NCUA Share Insurance

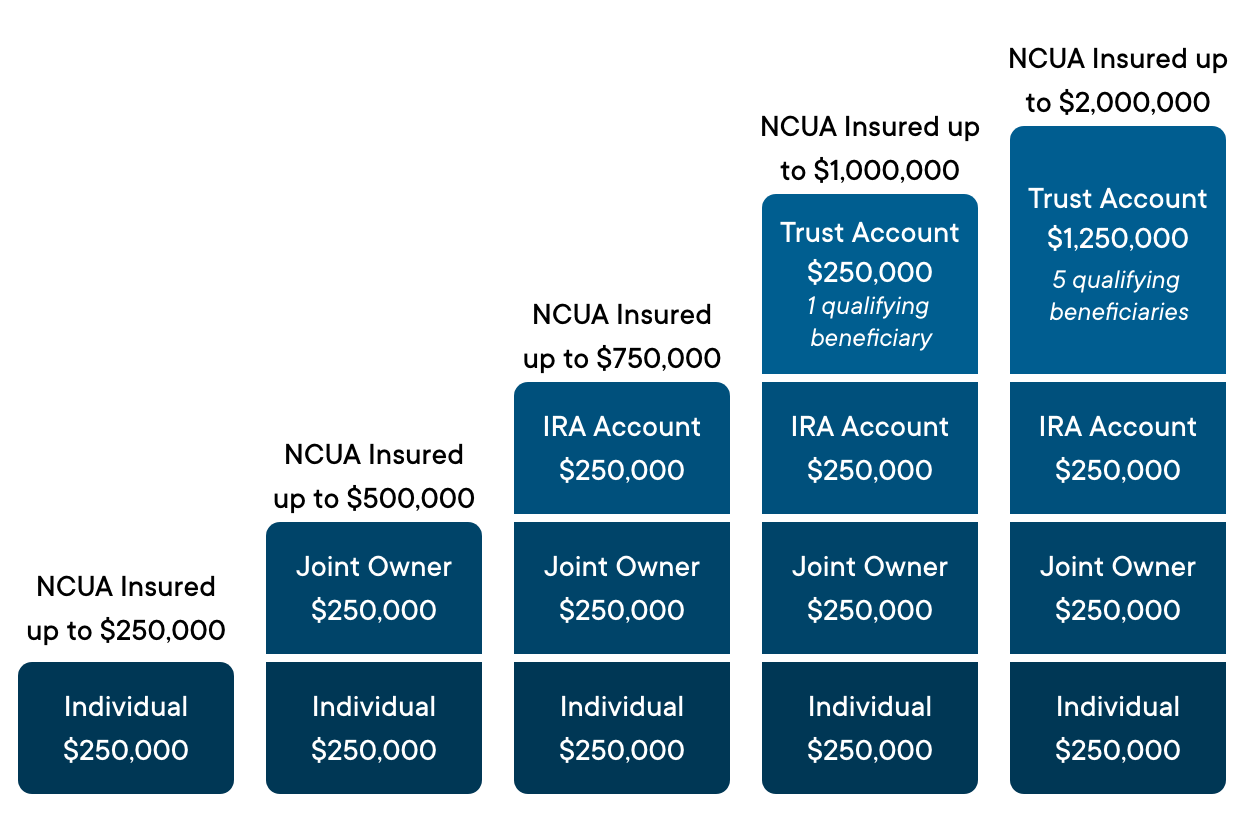

NCUA Share Insurance covers up to $250,000 in each member's account separately, based on the ownership category of the account. The most common ownership categories are shown in the chart below.

Deposits in trust accounts, including POD accounts, may have additional insurance coverage depending on the number of each owner’s named beneficiaries.

Maximize your account coverage

If you have several credit union accounts and would like to know how to structure them for maximum insurance coverage, visit the NCUA website and use the Share Insurance Estimator.

You may obtain additional separate coverage on multiple accounts, but only if you have different ownership interests or rights in different types of accounts, and you complete the appropriate forms.

Other ways we protect your money

LGFCU uses several methods to make certain member deposits remain secure:

- Invests savings dollars in safe, secure investments, primarily loans to other members

- Undergoes regularly scheduled exams performed by the NCUA and an external CPA auditing firm

- Receives oversight by the LGFCU Supervisory Committee

- Undergoes periodic audits of operations departments and branches by SECU Audit Services (LGFCU provides operations and branch support for its members via the SECU network)

- Bonds all employees who have access to account information

- Maintains property insurance to guard against losses by fire and theft

- Sets aside annual reserves for additional protection as required by law