Branching out

Your need-to-know on our new branches

When you talk, we listen! That’s because you, as a member, know best: What you need and what you want, when it comes to managing your financial business.

Ultimately, the journey to LGFCU independence means you get lots of new options, with us here to help you make the most of them.

“We want members to know they have a choice in how they bank, to decide what works for them and when,” says CEO Dwayne Naylor. “We want to offer members convenience and choices that empower them, and new ways to partner with us that make them comfortable.”

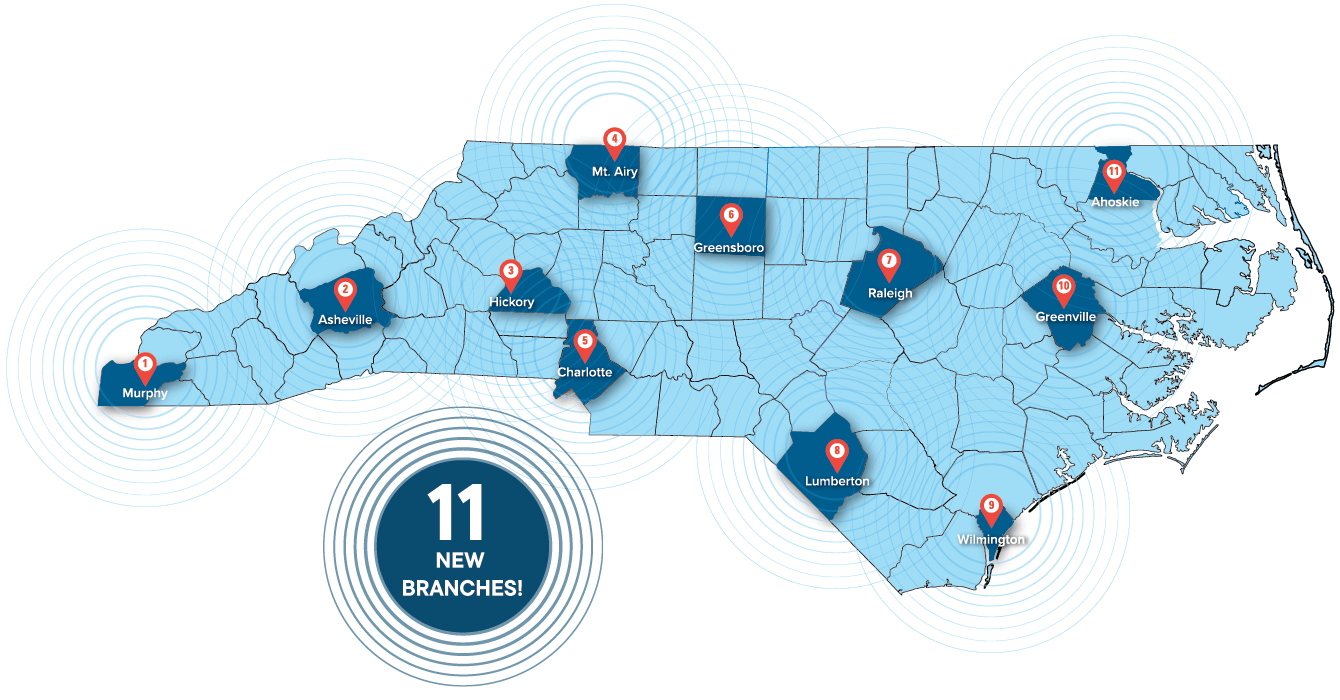

So, along with new cash solutions and co-locations, we’re adding 11 branches to our big plans for the future!

We’ve put together this quick Q&A to share the latest.

Q: Why branches?

A: That’s easy: Because you asked for them!

Q: Where will the branches be located?

A: Ready? Ahoskie, Asheville, Charlotte, Greensboro, Greenville, Hickory, Lumberton, Mount Airy, Murphy, Raleigh and Wilmington!

We chose these branch locations because 80% of our members live within 30 miles of one or more of them.

Q: What can I expect at the new branches?

A: An experience that’s different than ever before! Our dedicated staff, ready to help you identify solutions to your needs, and guide you through the Civic experience.

Cash transactions (in addition to the hundreds of retail partners we’ll have statewide, for you to deposit cash and use your debit card!). And a place that brings value to your local community.

Q: Who can visit these branches?

A: As an LGFCU member, you can enjoy sneak-peek tours of our new branches, learn more about Civic, and even join Civic on the spot.

If you’re already a Civic member, you can conduct transactions at these branches the minute they open. And when LGFCU becomes an independent credit union in 2025, all members can take advantage of these branches!

Of course, many of our members are happy banking online, so it’s OK if you don’t want or need to visit a branch. Our goal is to be a local, digital credit union that empowers you to bank your own way, on your own time!

Stay tuned …

‘Here for you and with you’

Why this member says Civic is LGFCU’s smartest move ever

Tony Beasley Inspections Director, Town of Garner (retired) LGFCU member since 2017; Civic member since 2019

After working for 39 years in economic and community development within local government, Tony Beasley clearly sees the connections between his career and his credit unions.

“A job in local government gives you the satisfaction of knowing you can make a difference in your community. And the credit union knows the steadfastness of local government employees, and cares about its members,” Tony says.

“It’s a true benefit to be a member, especially when you use the services to the full extent. The credit union is here for you and with you.”

Tony has relied on LGFCU to finance his vehicles, and for a home equity line of credit to remodel his family’s 1920s-era homestead. At Civic, he takes advantage of bonus dividends on checking, and great returns on his Money Market account.

“I sync my LGFCU and Civic accounts so I can see everything with one login, and can transfer money between accounts,” Tony says. “If I have a question, the [Civic] online chat is phenomenal. And it’s all done through the credit union platform!”

Now retired, Tony is still sharing his credit union story.

“When I tell local government employees who have businesses on the side, like mowing or painting or an online boutique, they’re thrilled about Civic,” Tony says. “It wins them over, to find out they can have all the benefits of the credit union and an enterprise account, without the big fees of banks.

“I see Civic as another great benefit to being a member of LGFCU,” he says. “To me, the fact that LGFCU launched Civic is the smartest thing anybody has ever done to benefit members.”

The Launch List

‘Tis the season for credit union news – check out the latest launches at Civic!

Civic mortgages now available

Fixed-rate loans at 15- and 30-year terms, adjustable-rate loan options, and a first-time homebuyer loan! See them all.

Civic Business Choice Certificate 6

A new 6-month term for this popular product, helping members earn while growing their businesses. Check it out, plus terms up to 5 years!

Did you know?

2: LGFCU is the second largest credit union in North Carolina in membership numbers, at 402,000

5: Civic can serve more than 5 times the LGFCU membership – and growing!

4: Average number of minutes it takes to open a Civic account

9: Number of years LGFCU has been building Civic

17: Less than 17% of LGFCU members’ transactions now occur in a branch – which is why we created Civic!

6,671: Number of people who joined LGFCU between January and September 2023

Your Foundation at work

Can a Civic Local Foundation grant save lives? Recent nonprofit grant recipient Pender County EMS & Fire is using its Foundation grant funds to deploy a new Quick Response Vehicle that will improve call response times to help citizens in medical need.

“We really want to make sure we’re doing the best we can for the Pender County citizens,” says Assistant Chief David Dudding. “Without your assistance, this first quick response truck couldn’t have happened.”

Happy holidays!

We’re grateful to our members who work every day, including holidays, to keep our communities safe and provide services many of us take for granted. While we can’t promise you a stroll in the snow (this is North Carolina after all), we wish our holiday heroes – and all our members – a happy season full of reasons to be jolly!